Did goofy talk between a couple mimicking cartoon characters lead to murder?

Linda Duffey shot her husband Patrick in their suburban California home — that is clear. What's not so clear is what led up to the shooting.

Watch CBS News

Linda Duffey shot her husband Patrick in their suburban California home — that is clear. What's not so clear is what led up to the shooting.

A man suspected in his girlfriend's murder swears he didn't do it – can his Fitbit prove he's innocent?

Officers stopped the suspects' vehicle just seven minutes after the final robbery.

Based on surveillance video, investigators believe the suspect may be in the Euless or Mid-Cities area.

Katy Perry powered through a midair prop malfunction during her concert in San Francisco, California, on Friday night.

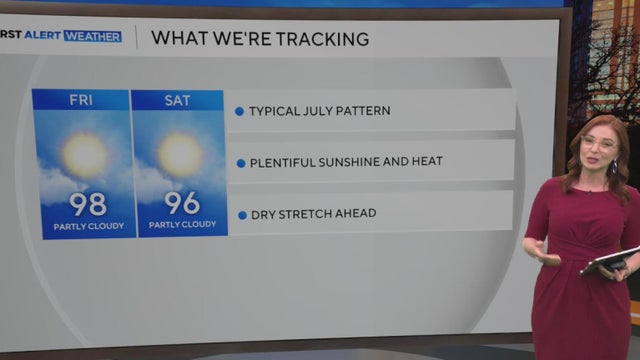

A typical summertime weather pattern is in place with lots of sunshine, heat and very little rain.

A lawyer for the maker of the video game Call of Duty is arguing that a judge should dismiss a lawsuit brought by families of the victims of the Uvalde, Texas, school shooting.

Authorities determined that three people are still missing from the floods, a sharp drop from the approximately 100 people authorities had previously said were unaccounted for.

Every week, we'll talk to a different person who contributed to the project or will work closely with it.

Several organizations are accepting donations for those impacted by the floods, as well as first responders and volunteers.

More than 600 people turned out for a charity screening of "How to Train Your Dragon" to support families recovering from July floods.

Millions of dollars are funneling in to help the community in the Hill Country floods, but where is all that money going?

The flood on July Fourth completely leveled Mike Richards' cabin on the Guadalupe River. But these days, he's not worried about his cabin.

"One minute you've lost everything you have and the next minute you feel blessed and full of hope," said Georgia "Cooney" Wells.

Kroger said it intentionally decreased prices, but some customers said the financial drop at the register went in a different direction.

Sidhartha "Sammy" Mukherjee and his wife Sunita became known for their Bollywood-style performances, became local celebrities, hosting parties and headlining music and cultural events.

DPD said Senior Corporal Le Chau was wanted for a charge of theft $30,000 - $150,000, a third-degree felony.

The Tarrant County Sheriff's Office and The Potter's House in Fort Worth teamed up on Saturday to help kids in need as summer break comes to an end.

A typical summertime weather pattern is in place with lots of sunshine, heat and very little rain.

Seventeen-year-old Brianna Ibarra from North Texas lives with epidermolysis bullosa, also known as "butterfly skin," a rare condition that causes her skin to blister or tear from even the slightest friction. Despite the daily pain and limitations, Brianna has found joy and healing through painting.

Thirty-two years after 8-year-old Kim Nguyen disappeared from his Garland home, his family and community are still seeking justice. Kim, who had autism and was non-verbal, was later found dead in a Mesquite field. His case remains unsolved, but pink ribbons now line his neighborhood as a symbol of remembrance and renewed hope.

The mother of 8-year-old Blakely McCrory, one of the Camp Mystic flood victims, shared heartfelt memories of her daughter. Lindsay McCrory said Blakely wasn’t nervous about camp. She wrote letters home describing how much she enjoyed the food and how well she was sleeping.

A typical summertime weather pattern is in place with lots of sunshine, heat and very little rain.

A typical summertime weather pattern is in place with lots of sunshine, heat and very little rain.

Temperatures in North Texas will be in the upper 90s for the foreseeable future.

Get ready for the heat. A dry, hot stretch is on the way with temperatures in the upper 90s.

SB 36 will create a division of Homeland Security within Texas's Department of Public Safety.

Two weeks ago, the Trump administration began carrying out its latest tactic aimed at fast-tracking deportations.

The detentions come on the heels of similar arrests earlier this week in immigration courts across the country.

Multiple sources have confirmed that at least a handful of people were arrested on the spot after their cases were dismissed in Dallas.

While illegal migrant crossings have dropped, immigration courts now have a historically high volume of cases

With the expansion of the 287(g) program, local and state officers will be able to enforce some immigration duties.

While the Trump administration says they're only targeting criminals for deportation, those words have done little to comfort some immigrants

A few weeks into his second term, President Donald Trump has issued dozens of executive orders.

Two faith leaders view border politics through different lenses.

Seager's go-ahead hit that also extended his on-base streak to 19 games.

The wide receiver was sentenced on Thursday in a Dallas County courtroom.

A'ja Wilson scored a season-high 37 points and the Las Vegas Aces beat the Dallas Wings Wednesday night in Arlington.

Kyle Schwarber went 3 for 3 in the first All-Star Game home run swing-off to put the National League ahead 4-3 following a 6-6 tie in which the American League rallied from a six-run deficit.

Texas quarterback Arch Manning admits that being the backup was tough after playing every year in high school.

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Linda Duffey shot her husband Patrick in their suburban California home — that is clear. What's not so clear is what led up to the shooting.

A man suspected in his girlfriend's murder swears he didn't do it – can his Fitbit prove he's innocent?

Officers stopped the suspects' vehicle just seven minutes after the final robbery.

Based on surveillance video, investigators believe the suspect may be in the Euless or Mid-Cities area.

Katy Perry powered through a midair prop malfunction during her concert in San Francisco, California, on Friday night.

Sidhartha "Sammy" Mukherjee and his wife Sunita became known for their Bollywood-style performances, became local celebrities, hosting parties and headlining music and cultural events.

On Thursday, the Texas House and Senate announced the creation of committees on disaster preparedness and flooding.

In what experts call "Flash Flood Alley," the terrain reacts quickly to rainfall steep slopes, rocky ground, and narrow riverbeds leave little time for warning.

For days before catastrophic floods left parts of Central Texas inundated, the National Weather Service was tracking the chance of rain.

Lt. Gov. Dan Patrick told CBS News Monday that the state of Texas could pay for storm sirens along the Guadalupe River.

The EPA's Office of Research and Development has more than 1,500 employees, including scientists and researchers, dispersed across the U.S.

Texas Democratic state Rep. Mihaela Plesa of Dallas discusses upcoming special session topics, including flooding warning systems, emergency communications and THC product regulations.

Senior Reporter at the Texan Brad Johnson, and Politics Editor at the Texas Tribune Jasper Scherer, discuss the expanded special session agenda by Gov. Greg Abbott. The agenda includes flooding warning systems and emergency communications, as well as hot button topics like redrawing Texas Congressional districts.

Lt. Governor Dan Patrick pushed Senate Bill 3 during the regular session but Gov. Greg Abbott vetoed the bill because of concerns over legal challenges.

President Trump has filed a lawsuit over a story the Wall Street Journal published about an alleged birthday letter to Jeffrey Epstein.

At Fort Worth ISD's North Side High School, the sounds of an American sport on the field meet mariachi music in the stands.

With new foods, such as the "Drowning Taquitos" and the "Beso de Angel," Tony's Taco Shop owners say they don't take their success for granted.

Latinas in Tech DFW started back up last year after the pandemic. They have lots of opportunities for Latinas to network, connect, and learn new skills.

Anchor Ken Molestina shows us how he makes his Cuban coffee for the CBS News Texas newsroom.

Del Olmo, who has played golf his entire life, recalls how rare the sport was for people like him growing up in Mexico City.

Less than two days after Delta Air Lines offered $30,000 to each passenger on board the flight that crashed and flipped in Toronto on Monday afternoon, the company is facing its first two lawsuits in the incident — and they likely won't be the last.

Texas Agricultural Commissioner Sid Miller is calling for a statewide ban on non-water additives, such as fluoride, in the public water system.

Last year, over 16 million vehicles drove on North Texas toll roads without paying, accumulating more than $69 million in unpaid tolls.

Activists are calling for a nationwide boycott of Target stores following the company's decision to roll back its diversity, equity and inclusion initiatives.

Discount store chain Target says it's joining rival Walmart and a number of other prominent American brands in scaling back corporate diversity, equity and inclusion initiatives.

Many Southeast, Southern and West Coast states are likely seeing an increase in COVID cases.

It's therapy that doesn't exactly look like therapy: outdoors, alongside a horse. Across North Texas, the demand for it is soaring.

Scientists conducting medical research are facing an existential crisis: Layoffs and budget cuts pushed by President Trump that, they say, jeopardize finding a cure for cancer.

A Dallas mail carrier died Saturday after collapsing on his mail route on the first day of summer.

Pest control company Terminix used call data to determine which cities had the most bed bug-infested areas in the country.

Kroger said it intentionally decreased prices, but some customers said the financial drop at the register went in a different direction.

Could the solution to school shootings be drone first responders? An Austin-based tech company thinks so and is testing them at a private high school in Aurora.

Located off the Guadalupe River in Historic Old Ingram Loop, the shop was once filled floor to with lighting, decor and trinkets.

They were already concerned about tariffs, but construction businesses in North Texas said they have new fears with the president's immigration crackdown.

The Texas Restaurant Association said 47% of Texas restaurant operators currently have job openings that are difficult to fill.

Seager's go-ahead hit that also extended his on-base streak to 19 games.

The wide receiver was sentenced on Thursday in a Dallas County courtroom.

A'ja Wilson scored a season-high 37 points and the Las Vegas Aces beat the Dallas Wings Wednesday night in Arlington.

Kyle Schwarber went 3 for 3 in the first All-Star Game home run swing-off to put the National League ahead 4-3 following a 6-6 tie in which the American League rallied from a six-run deficit.

Texas quarterback Arch Manning admits that being the backup was tough after playing every year in high school.

Katy Perry powered through a midair prop malfunction during her concert in San Francisco, California, on Friday night.

Peacock is hiking its prices as streaming platforms surpass traditional broadcasters in how people watch TV.

CBS will end "The Late Show with Stephen Colbert" and retire "The Late Show" franchise in May 2026, the company announced Thursday.

Connie Francis was a wholesome pop star of the 1950s and '60s whose personal life was filled with heartbreak and tragedy.

For the first time ever, the Broadway show "The Wiz" is bringing its magic to Fort Worth.

A suspect was taken into custody after an attack on Pearl Street Mall in Boulder on June 1 in which there were 15 people and a dog who were victims. The suspect threw Molotov cocktails that burned some of the victims, who were part of a march for Israeli hostages.

The Neonatal Intensive Care Unit babies at Texas Health locations across North Texas celebrated Valentine's Day.

As Anthony Davis prepared for his debut game at the AAC, Dallas Mavericks fans took to the arena to protest the controversial trade.

CBS News Texas viewers got out and enjoyed the snow day on Thursday and send us all of their best photos. Take a look.

CBS News Texas captured the excitement and energy of the BMW Dallas Marathon Festival through photos.