CBS News Live

CBS News Texas: Local News, Weather & More

Watch CBS News

The vehicles' failure to detect a "sudden degradation" in the battery could lead to to a sudden loss of power, Ford warns.

Elon Musk's 2018 compensation package is back for board re-certification after being voided by a Delaware court.

Rideshare passengers have been known to forget all manner of unusual items, from live animals to a car engine.

The Dallas Cowboys have signed free agent running back Royce Freeman.

An attorney for the accuser says they plan to refile the lawsuit in Collin County.

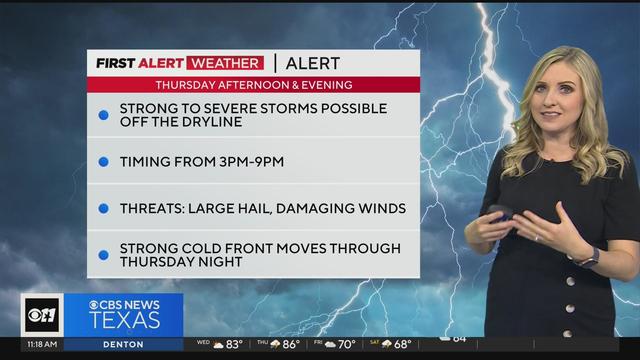

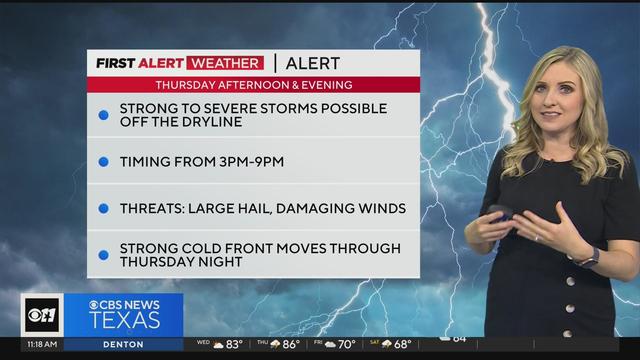

High temperatures will be in the mid 80s under mostly cloudy skies.

Prayers are vehicles for answers, but a group that came to a church on Dallas' west side looking for solutions to gun violence after a school shooting left with none.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

Officers determined the man had injuries "on his hands consistent with the incident," police said Tuesday.

Duncanville Animal Control took possession of the dogs.

Tyrese Simmons, who was charged with murder in the killing of Brandoniya Bennett, will plead guilty to manslaughter.

Raynaldo Ortiz's motive has never been perfectly clear, but prosecutors believe he was angry he was being investigated for errors in his own surgeries.

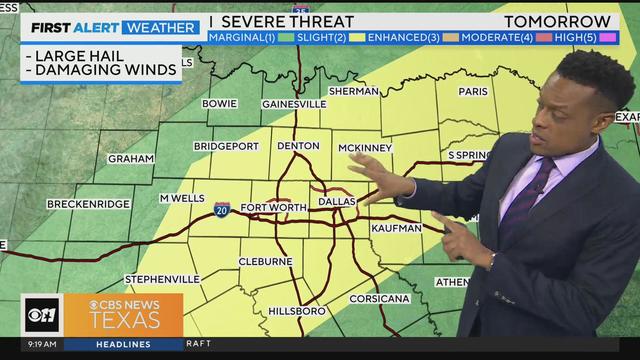

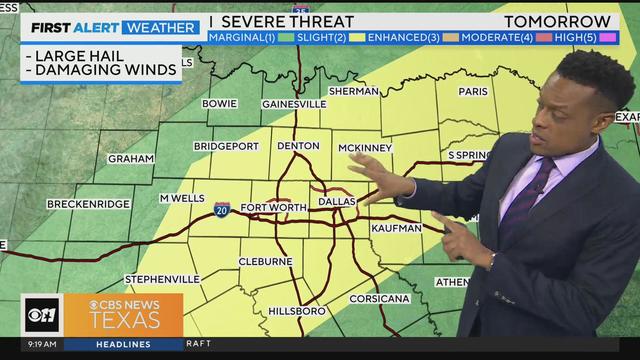

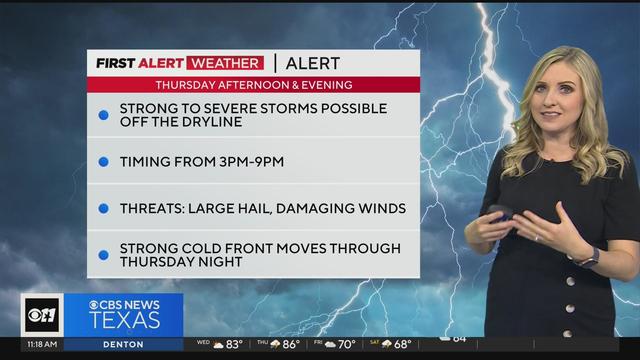

There will likely be a CAP in place over our atmosphere Thursday that will suppress storm develop for much of the day.

Dallas Cowboys quarterback Dak Prescott is no longer facing a sexual assault lawsuit in Dallas County. An attorney for the accuser says they plan to refile the lawsuit in Collin County.

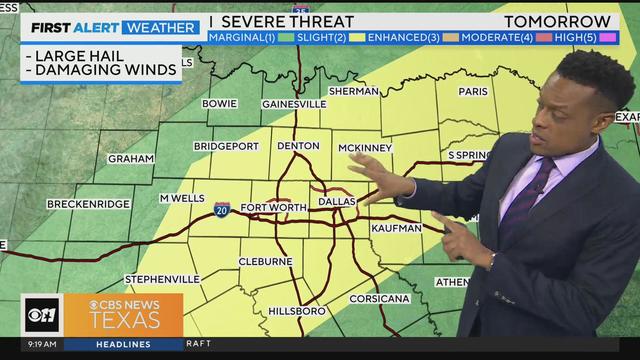

Most of the DFW Metroplex is under a slight risk for severe storms.

An attorney for the accuser says they plan to refile the lawsuit in Collin County.

Despite demand growing for electricity on warmer days, ERCOT made it through another evening without demand surpassing supply. However, Wednesday afternoon and evening will prove to be another test for the state's power grid.

There will likely be a CAP in place over our atmosphere Thursday that will suppress storm develop for much of the day.

Most of the DFW Metroplex is under a slight risk for severe storms.

High temperatures will be in the mid 80s under mostly cloudy skies.

Texas police departments have the discretion to determine the frequency and extent of additional driving training for their officers. While some require driving training yearly or every other year, others do not.

Some departments opt to melt the firearms down, while others choose to crush them. However, there are instances where firearms, or at least parts of them, escape destruction altogether.

Several police departments told the CBS News Texas I-Team they were unaware of this practice, even though it was stated in the contracts they signed with the company, Gulf Coast GunBusters.

It's a complicated process that not everyone qualifies for.

Tuesday, federal prosecutors called their first witnesses against Dr. Raynaldo Ortiz.

The Dallas Cowboys have signed free agent running back Royce Freeman.

An attorney for the accuser says they plan to refile the lawsuit in Collin County.

Michael Lorenzen pitched five spotless innings in his Texas debut and three relievers completed a five-hit shutout as the Rangers topped the Detroit Tigers 1-0.

Caitlin Clark has been selected with the No. 1 pick in the WNBA draft by the Indiana Fever.

"Scottie's a very humble guy. Wonderful personality and a great representative for Highland Park and for Dallas."

The vehicles' failure to detect a "sudden degradation" in the battery could lead to to a sudden loss of power, Ford warns.

Elon Musk's 2018 compensation package is back for board re-certification after being voided by a Delaware court.

Rideshare passengers have been known to forget all manner of unusual items, from live animals to a car engine.

The Dallas Cowboys have signed free agent running back Royce Freeman.

An attorney for the accuser says they plan to refile the lawsuit in Collin County.

Texas police departments have the discretion to determine the frequency and extent of additional driving training for their officers. While some require driving training yearly or every other year, others do not.

Some departments opt to melt the firearms down, while others choose to crush them. However, there are instances where firearms, or at least parts of them, escape destruction altogether.

Several police departments told the CBS News Texas I-Team they were unaware of this practice, even though it was stated in the contracts they signed with the company, Gulf Coast GunBusters.

It's a complicated process that not everyone qualifies for.

Tuesday, federal prosecutors called their first witnesses against Dr. Raynaldo Ortiz.

Dallas' mayor is also calling for city council members to agree not to include a golden parachute clause in the next city manager's contract.

The Senate is tasked with the trial after the House impeached Mayorkas earlier this year. Senate Democrats are expected to move to quickly quash the effort.

Seven Manhattan residents were selected Tuesday afternoon to serve on the jury in former President Donald Trump's criminal trial.

If approved by voters during the May 4 municipal election in Frisco, Prop A would institute civil service protections for firefighters. Prop B would provide collective bargaining over pay, benefits, and workplace conditions between firefighters and the city. Bill Woodard, a Frisco City Council Member since 2016, opposes both propositions.

Frisco Firefighters Association President Matthew Sapp told CBS News Texas after city leaders rejected using meet and confer to discuss their pay and benefits, their members decided to go directly to the residents.

Self-driving 18-wheelers have longtime truckers worried about their livelihood and others concerned that the technology needs more testing to make sure the public is safe.

McDonald's concept restaurant CosMc's has taken its drink-focused menu to Dallas for its second-ever location.

With the country on the cusp of greeting the return of spring, a warm-weather treat is once again available for free for a limited time only.

Kelli and Michael Regan were looking for a new dog. The breeder they found online asked them to pay with gift cards.

Target, looking for ways to add sales, is relaunching its Target Circle loyalty program including a new paid membership with unlimited free same-day delivery in as little as an hour for orders over $35.

The $872 million most likely excludes any amount UnitedHealth may have paid to hackers in ransom.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

Most worrisome gaps involve cancer chemotherapy drugs, ER medications and and therapies for ADHD.

The prepackaged boxes of deli meat, cheese and crackers are not a healthy choice for kids, advocacy group says.

This marks only the second-ever case of bird flu in humans in the U.S.

The projects are expected to create at least 17,000 construction jobs and 4,500 manufacturing jobs.

After more than 40 years in business, 99 Cents Only Stores, a discount chain, announced on Thursday that it will close all 371 of its locations and cease operations.

"This is huge, HUGE! If we don't plan appropriately, A, we won't have workers. Or B, we'll have so many people on the streets that nobody can get to the events."

"This is going to be an event all the way through the weekend, even starting as early as Friday."

Federal officials say milk from dairy cows in Texas and Kansas has tested positive for bird flu.

The Dallas Cowboys have signed free agent running back Royce Freeman.

An attorney for the accuser says they plan to refile the lawsuit in Collin County.

Michael Lorenzen pitched five spotless innings in his Texas debut and three relievers completed a five-hit shutout as the Rangers topped the Detroit Tigers 1-0.

Caitlin Clark has been selected with the No. 1 pick in the WNBA draft by the Indiana Fever.

"Scottie's a very humble guy. Wonderful personality and a great representative for Highland Park and for Dallas."

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

A judge in Texas is to hear arguments in rap star Travis Scott's request to be dismissed from a lawsuit over the deadly 2021 Astroworld festival in Houston.

Eleanor documented much of the chaos on "Apocalypse Now" in what would become one of the most famous making-of films about moviemaking, 1991's "Hearts of Darkness: A Filmmaker's Apocalypse."

CBS announces "The Talk" is ending its award-winning run in December with a shortened season 15.

There will likely be a CAP in place over our atmosphere Thursday that will suppress storm develop for much of the day.

Dallas Cowboys quarterback Dak Prescott is no longer facing a sexual assault lawsuit in Dallas County. An attorney for the accuser says they plan to refile the lawsuit in Collin County.

Most of the DFW Metroplex is under a slight risk for severe storms.

An attorney for the accuser says they plan to refile the lawsuit in Collin County.

Despite demand growing for electricity on warmer days, ERCOT made it through another evening without demand surpassing supply. However, Wednesday afternoon and evening will prove to be another test for the state's power grid.

Dallas artist Roberto Marquez traveled to the Rafah Crossing in Egypt, the U.S. capital and will attend this weekend's statewide protest in Austin.

On Friday, hundreds of thousands of fans gathered outside and all around Globe Life Field in Arlington to celebrate the Texas Rangers historical World Series win!

Babies in the neonatal intensive care unit at several Texas Health hospitals were dressed in creative costumes for Halloween.

Is that the smell of cotton candy, beignets and brisket wafting over Fair Park? It sure is, and we are here for it!

No one puts these dolls back in their boxes. Babies in the neonatal intensive care unit at Texas Health Harris Methodist Hospital Southwest Fort Worth are pretty in pink!