CBS News Live

CBS News Texas: Local News, Weather & More

Watch CBS News

Follow live updates as Stormy Daniels testifies at former President Donald Trump's trial in New York.

2 Ukrainian security officers have been detained and accused of treason over an alleged Russian plot to kill President Volodymyr Zelenskyy.

CBS News Texas has new information from the Allen Police Department about its investigation into the outlet mall shooting that reveals for the first time the massive amount of manpower that responded to the scene.

The visualization, produced on a NASA supercomputer, allows users to experience flight towards a supermassive black hole.

Corey Seager hit a three-run homer in the eighth inning and the Texas Rangers rallied past the Oakland Athletics 4-2.

Highs will warm into the upper 80s by the afternoon. Tonight, temperatures will be in the low 70s under mostly clear skies.

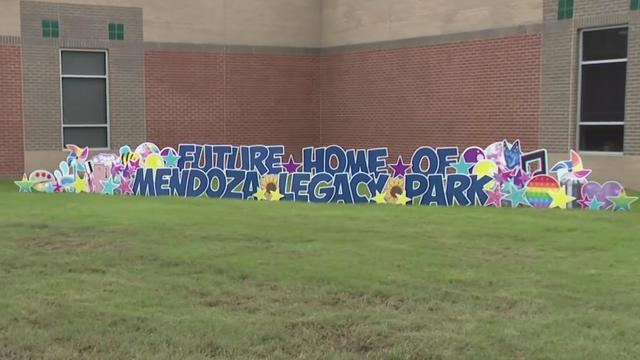

The memorial has eight wind chimes hanging at the top, honoring each of the lives lost on May 6, 2023.

It will have butterfly benches among trees and greenery, a bird feeder, and a small, free library - all reflections of the sisters' interests and dreams.

A tornado destroyed homes and toppled trees and power lines when it roared through a small northeast Oklahoma city, one of several twisters that erupted in the central United States amid a series of powerful storms.

The 97-year-old is one of 19 individuals who received the nation's highest civilian honor Friday.

According to Johnson County Emergency Management, someone called 911 around 2 a.m. to report a car that was stuck in swift-moving water.

In the harrowing live video from Freddy McKinney, he yells at the family to "Hurry, get inside!" as they run for their lives, begging him for help.

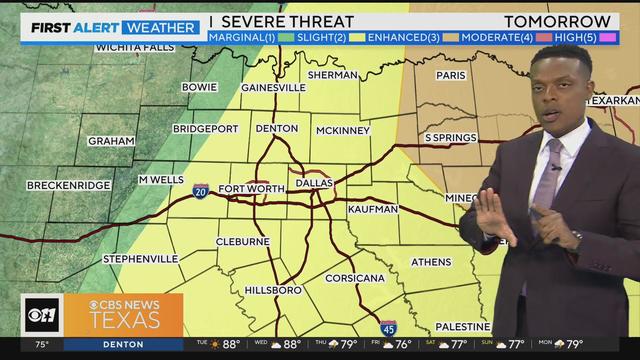

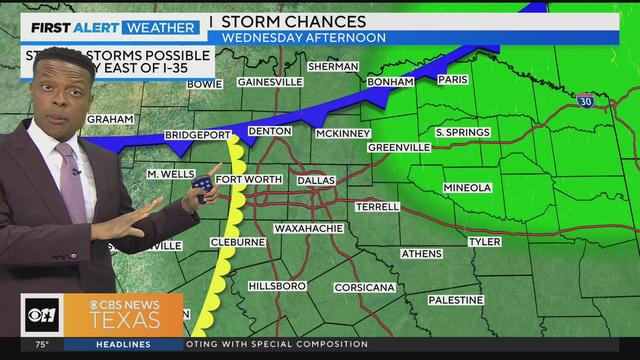

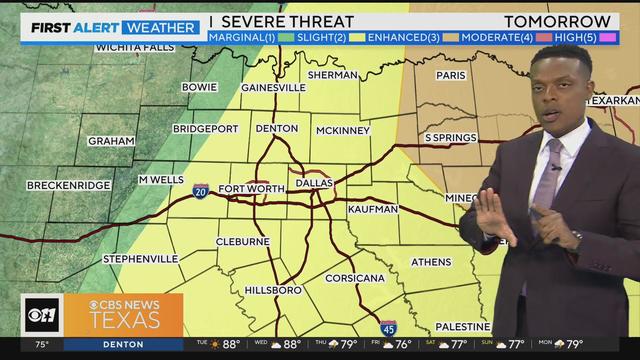

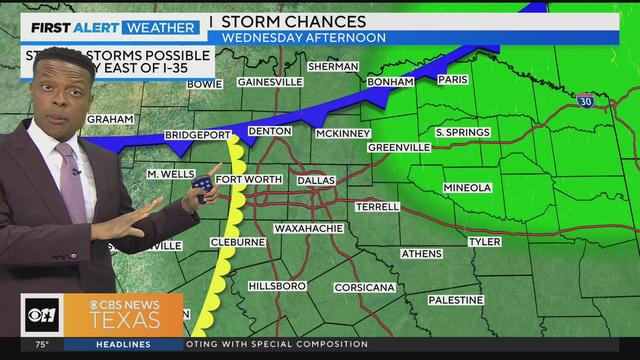

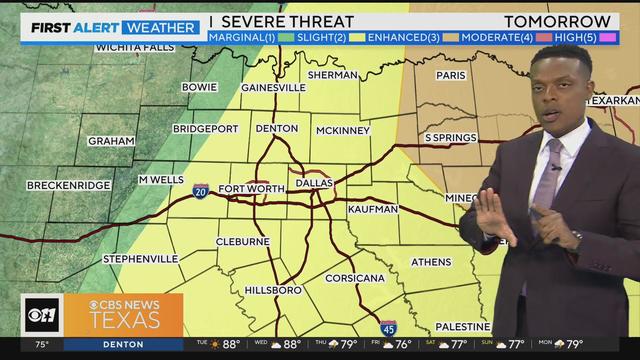

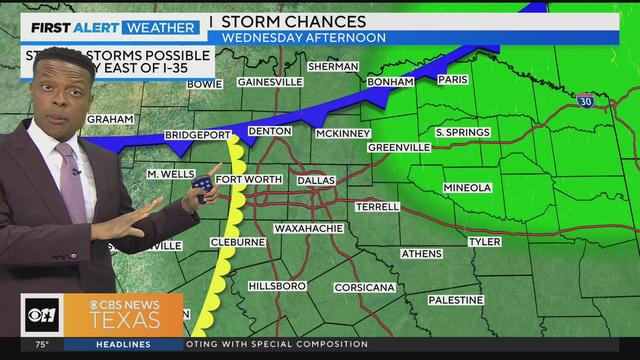

A few isolated, strong storms could develop in North Texas.

The group, formerly known as Texas Baptist Men, is on the way to Houston to support victims of recent flooding. That support includes laundry, food, water and other necessities.

Many roads and highways are shut down in the Oklahoma town after a tornado touched down overnight Monday. Barnsdall is located about 40 miles north of Tulsa.

Imagine being charged tens of thousands of dollars for something you never wanted or even received. It’s a complaint the CBS News Texas I-Team received from a garland woman who considered purchasing solar panels.

In the meantime, Tuesday will have a mix of sun, clouds and heat.

A few isolated, strong storms could develop in North Texas.

Highs will warm into the upper 80s by the afternoon. Tonight, temperatures will be in the low 70s under mostly clear skies.

In the meantime, Tuesday will have a mix of sun, clouds and heat.

In a statement, Philips said it does not admit any wrongdoing but chose to settle "to end the uncertainty associated with litigation in the U.S."

A scammer a North Texas woman met on Instagram claimed to be a German cardiologist, and for months, the two messaged back and forth, building what she thought was a true relationship.

Texas police departments have the discretion to determine the frequency and extent of additional driving training for their officers. While some require driving training yearly or every other year, others do not.

Some departments opt to melt the firearms down, while others choose to crush them. However, there are instances where firearms, or at least parts of them, escape destruction altogether.

Several police departments told the CBS News Texas I-Team they were unaware of this practice, even though it was stated in the contracts they signed with the company, Gulf Coast GunBusters.

Corey Seager hit a three-run homer in the eighth inning and the Texas Rangers rallied past the Oakland Athletics 4-2.

The announcement comes a day before the Mavericks face the Oklahoma City Thunder in the Western Conference Semifinals.

The Dallas Stars take the series 4-3 with a 2-1 victory in Game 7 over the defending champion Vegas Golden Knights.

It was just the 10th Kentucky Derby decided by a nose, and the first since Grindstone wore the garland of red roses in 1996.

Luka Doncic had 28 points and 13 assists, Kyrie Irving scored 28 of 30 points in a second-half surge and the Dallas Mavericks advanced to the second round of the playoffs with a 114-101 victory over the Los Angeles Clippers.

Follow live updates as Stormy Daniels testifies at former President Donald Trump's trial in New York.

2 Ukrainian security officers have been detained and accused of treason over an alleged Russian plot to kill President Volodymyr Zelenskyy.

CBS News Texas has new information from the Allen Police Department about its investigation into the outlet mall shooting that reveals for the first time the massive amount of manpower that responded to the scene.

The visualization, produced on a NASA supercomputer, allows users to experience flight towards a supermassive black hole.

Corey Seager hit a three-run homer in the eighth inning and the Texas Rangers rallied past the Oakland Athletics 4-2.

In a statement, Philips said it does not admit any wrongdoing but chose to settle "to end the uncertainty associated with litigation in the U.S."

A scammer a North Texas woman met on Instagram claimed to be a German cardiologist, and for months, the two messaged back and forth, building what she thought was a true relationship.

They found him guilty – now four jurors are explaining how they were convinced to convict Dr. Raynaldo Ortiz.

Texas police departments have the discretion to determine the frequency and extent of additional driving training for their officers. While some require driving training yearly or every other year, others do not.

Some departments opt to melt the firearms down, while others choose to crush them. However, there are instances where firearms, or at least parts of them, escape destruction altogether.

Follow live updates as Stormy Daniels testifies at former President Donald Trump's trial in New York.

Without a major change, Social Security may be forced to cut benefits in 2035, a year later than previously forecast.

A U.S. soldier has been detained in Russia, officials confirmed.

Israeli Prime Minister Benjamin Netanyahu's office says the proposal is "far from meeting Israel's core demands."

Judge Juan Merchan said former President Donald Trump violated his gag order on April 22 when he commented on the political makeup of the jury.

Self-driving 18-wheelers have longtime truckers worried about their livelihood and others concerned that the technology needs more testing to make sure the public is safe.

McDonald's concept restaurant CosMc's has taken its drink-focused menu to Dallas for its second-ever location.

With the country on the cusp of greeting the return of spring, a warm-weather treat is once again available for free for a limited time only.

Kelli and Michael Regan were looking for a new dog. The breeder they found online asked them to pay with gift cards.

Target, looking for ways to add sales, is relaunching its Target Circle loyalty program including a new paid membership with unlimited free same-day delivery in as little as an hour for orders over $35.

Steward Health Care, the struggling hospital group that owns hospitals in Massachusetts, Texas, Florida and other states, announced Monday that it is filing for bankruptcy.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

A North Texas mother partnered with the Texas Health Resources Foundation to provide a potentially life-saving tool to at-risk pregnant and postpartum moms.

Plaintiffs have three months to vote on whether to approve a proposed legal settlement that would resolve nearly all talc lawsuits.

Cat deaths and neurological disease are "widely reported" around farms where the H5N1 bird flu virus was detected, health officials say.

Within hours of the vote, the U.S. Chamber of Commerce announced it would sue to block the ban. Dallas employment attorney Rogge Dunn predicts employees will ultimately win this battle.

The closure affects both Dom's locations in Chicago, and all 33 Foxtrot stores in Chicago, Texas, and the Washington D.C. area.

Texas law SB 14 prohibits drug and surgical "gender transition" interventions for minors.

The projects are expected to create at least 17,000 construction jobs and 4,500 manufacturing jobs.

After more than 40 years in business, 99 Cents Only Stores, a discount chain, announced on Thursday that it will close all 371 of its locations and cease operations.

Corey Seager hit a three-run homer in the eighth inning and the Texas Rangers rallied past the Oakland Athletics 4-2.

The announcement comes a day before the Mavericks face the Oklahoma City Thunder in the Western Conference Semifinals.

The Dallas Stars take the series 4-3 with a 2-1 victory in Game 7 over the defending champion Vegas Golden Knights.

It was just the 10th Kentucky Derby decided by a nose, and the first since Grindstone wore the garland of red roses in 1996.

Luka Doncic had 28 points and 13 assists, Kyrie Irving scored 28 of 30 points in a second-half surge and the Dallas Mavericks advanced to the second round of the playoffs with a 114-101 victory over the Los Angeles Clippers.

'Bob Hearts Abishola', the acclaimed comedy, is signing off after its fifth season on CBS.

Bernard Hill died Sunday at 79. The actor was known for his roles in "Lord of the Rings" and "Titanic."

"Sunday Morning" has an exclusive behind-the-scenes look at the creation of the country singer's first post-stroke song, "Where That Came From," which blends art with artificial intelligence in a recording that captures Travis' country heart.

The start of the first civil trial stemming from the deadly crowd surge at the 2021 Astroworld festival in Texas has been delayed.

"Happy 9th Birthday, Princess Charlotte!" the Prince and Princess of Wales said in a social media post with a new photo of their daughter taken by Kate.

A few isolated, strong storms could develop in North Texas.

The group, formerly known as Texas Baptist Men, is on the way to Houston to support victims of recent flooding. That support includes laundry, food, water and other necessities.

Many roads and highways are shut down in the Oklahoma town after a tornado touched down overnight Monday. Barnsdall is located about 40 miles north of Tulsa.

Imagine being charged tens of thousands of dollars for something you never wanted or even received. It’s a complaint the CBS News Texas I-Team received from a garland woman who considered purchasing solar panels.

In the meantime, Tuesday will have a mix of sun, clouds and heat.

A storm chaser not only captured a massive tornado touching down in Hawley, Texas on Thursday but ended up rescuing a family of four whose home was destroyed by it.

Dallas artist Roberto Marquez traveled to the Rafah Crossing in Egypt, the U.S. capital and will attend this weekend's statewide protest in Austin.

On Friday, hundreds of thousands of fans gathered outside and all around Globe Life Field in Arlington to celebrate the Texas Rangers historical World Series win!

Babies in the neonatal intensive care unit at several Texas Health hospitals were dressed in creative costumes for Halloween.

Is that the smell of cotton candy, beignets and brisket wafting over Fair Park? It sure is, and we are here for it!