CBS News Live

CBS News Texas: Local News, Weather & More

Watch CBS News

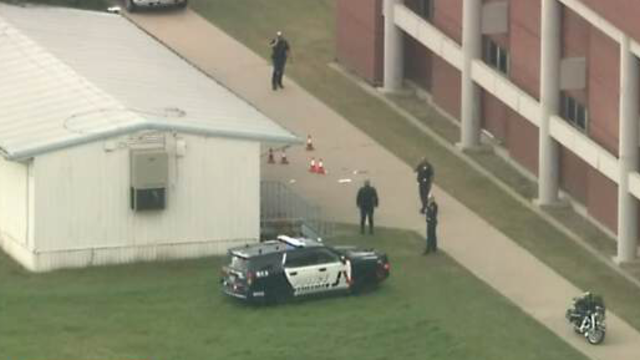

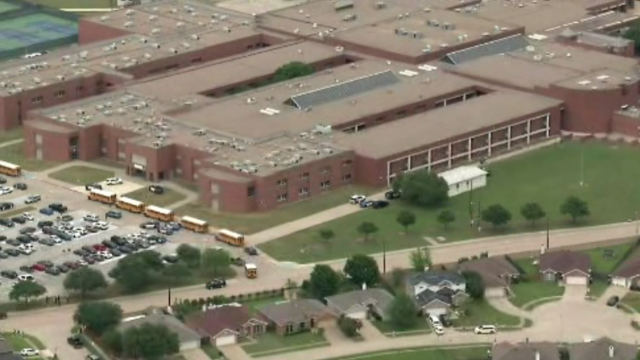

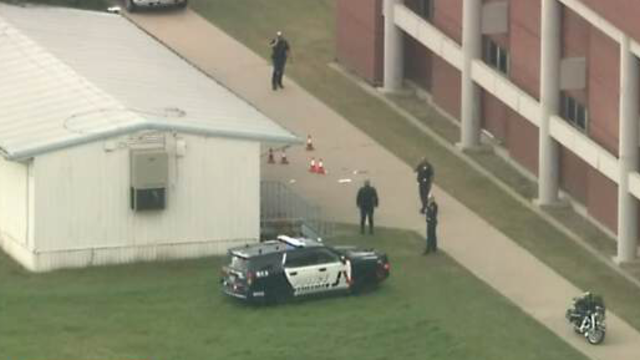

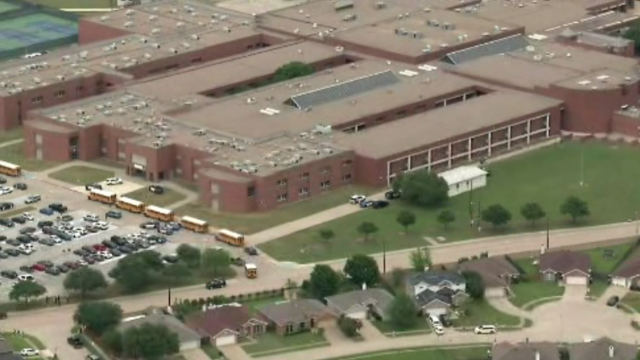

Arlington Police are still looking for a key piece of evidence in the deadly school shooting on Wednesday and many questions remain about what happened.

Police arrested 17-year-old Julian Howard and charged him with one count of murder in the death of Etavion Barnes, 18.

The victims were taken to a local hospital and are in stable condition.

The 2024 NFL Draft kicks off Thursday night in Detroit.

With the departure of Tyron Smith, Guyton has massive shoes to fill at left tackle. The starting job will not be given to him, but Jones did not draft him to watch him sit on the bench.

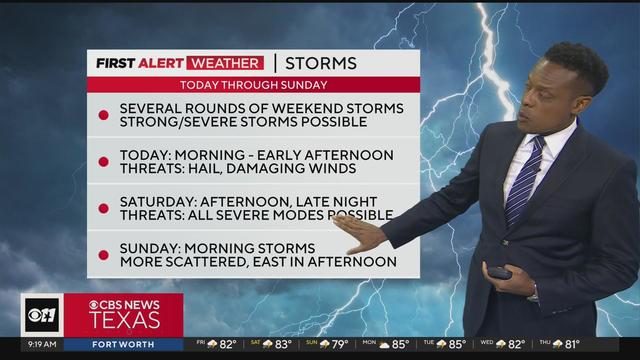

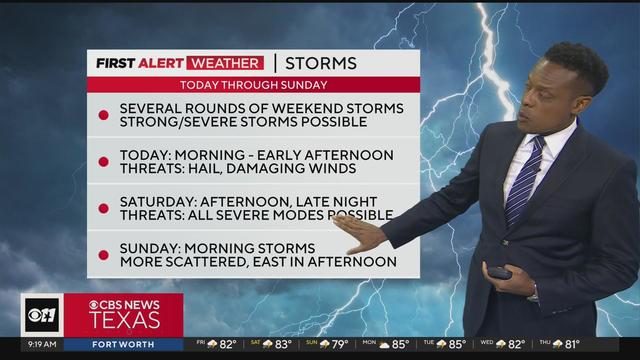

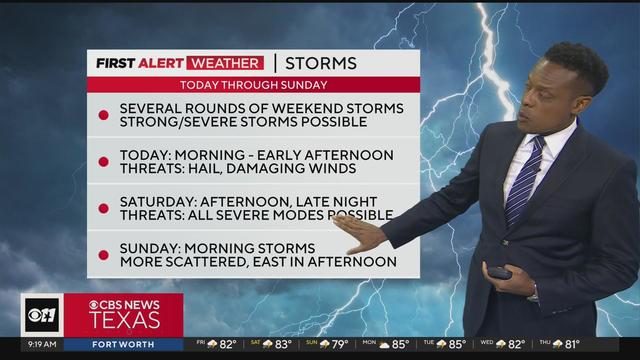

We're tracking several rounds of rain and storms today through your weekend.

Saint Andrews United Methodist Church is opening its door to neighbors who may need a different space to sort out a difficult day.

Students said this was about showing solidarity and not wanting the university to be associated with Israel's fight.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

"If we were to lose control of the Corporation and its assets it would allow the Defendants to remove us from our home, as they have already threatened to do," the Rev. Mother wrote. "I pray they be stopped."

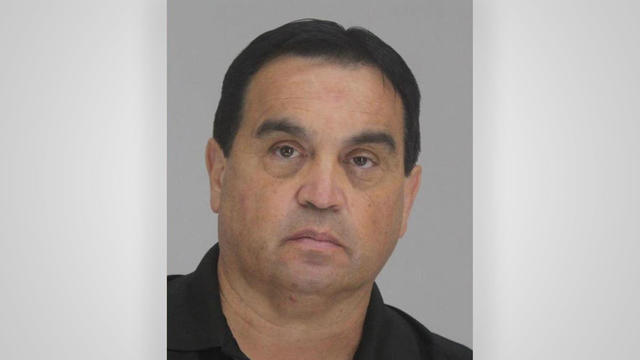

Don Steven McDougal, a family friend, was indicted by a Polk County grand jury in connection with the death of an 11-year-old girl.

Bois D'Arc Lake is now open to families, boaters and fishers just an hour northeast of DFW in Fannin County.

Storms are more likely this morning and early afternoon.

The Dallas-based airline says it lost $231 million. As a result, they will be cutting back on hirings and ending flights to four airports.

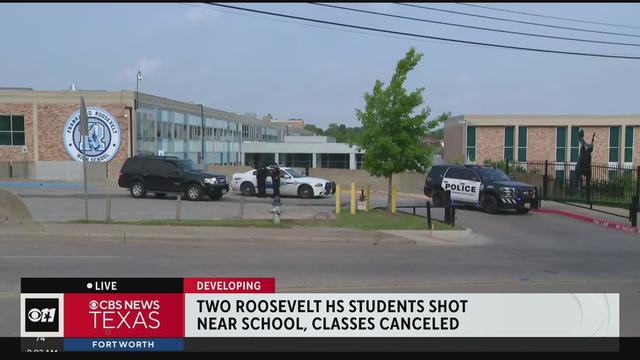

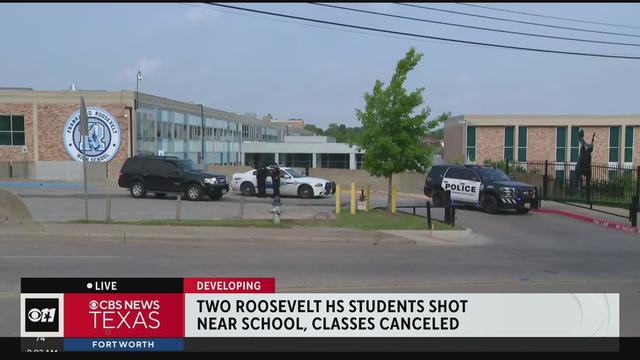

DISD announced that classes on Friday were canceled at Roosevelt High School of Innovation. The announcement came around midnight, hours after two students were shot near campus.

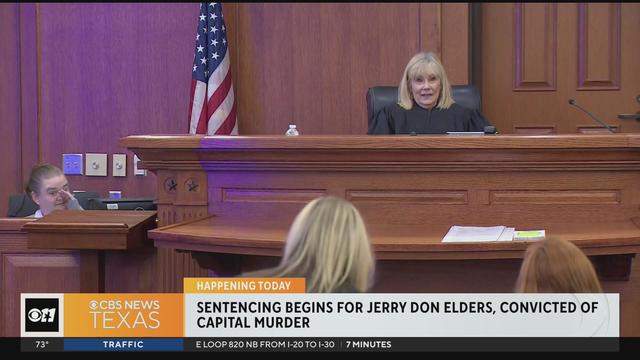

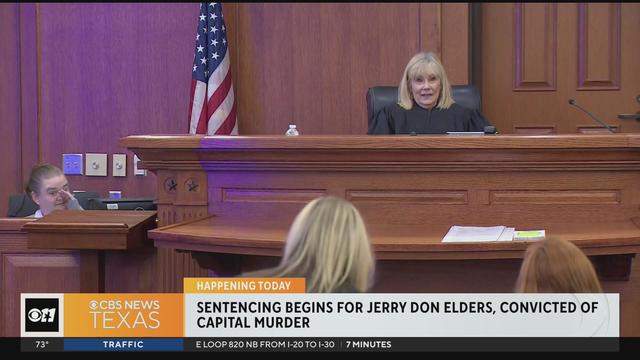

Life in prison or the death penalty will be next for Jerry Don Elders, who is facing sentencing Friday. A jury found him guilty Thursday of capital murder for killing Robin Wadell in 2021 after shooting an officer during a traffic stop.

In Forney, the search is growing for Wade Robison. The 22-year-old is believed to have walked away after crashing his car along Highway 80 and FM 460 Sunday. Thursday morning, Dallas Fire Rescue searched a nearby creek and have announced this is now a recovery mission.

Storms are more likely this morning and early afternoon.

We're tracking several rounds of rain and storms today through your weekend.

We're tracking several rounds of rain and storms today through your weekend.

A scammer a North Texas woman met on Instagram claimed to be a German cardiologist, and for months, the two messaged back and forth, building what she thought was a true relationship.

Texas police departments have the discretion to determine the frequency and extent of additional driving training for their officers. While some require driving training yearly or every other year, others do not.

Some departments opt to melt the firearms down, while others choose to crush them. However, there are instances where firearms, or at least parts of them, escape destruction altogether.

Several police departments told the CBS News Texas I-Team they were unaware of this practice, even though it was stated in the contracts they signed with the company, Gulf Coast GunBusters.

It's a complicated process that not everyone qualifies for.

With the departure of Tyron Smith, Guyton has massive shoes to fill at left tackle. The starting job will not be given to him, but Jones did not draft him to watch him sit on the bench.

The 2024 NFL Draft kicks off Thursday night in Detroit.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

Straight out of the 2024 Big Green NFL Draft Scouting Notebook, here's who the Cowboys won't draft this year, but should.

Noah Hanifin broke a tie with an unassisted goal late in the second period and the Stanley Cup champion Vegas Golden Knights beat the top-seeded Dallas Stars 3-1 on Wednesday night to take a 2-0 lead in the first-round series.

Arlington Police are still looking for a key piece of evidence in the deadly school shooting on Wednesday and many questions remain about what happened.

Police arrested 17-year-old Julian Howard and charged him with one count of murder in the death of Etavion Barnes, 18.

The victims were taken to a local hospital and are in stable condition.

The 2024 NFL Draft kicks off Thursday night in Detroit.

With the departure of Tyron Smith, Guyton has massive shoes to fill at left tackle. The starting job will not be given to him, but Jones did not draft him to watch him sit on the bench.

A scammer a North Texas woman met on Instagram claimed to be a German cardiologist, and for months, the two messaged back and forth, building what she thought was a true relationship.

They found him guilty – now four jurors are explaining how they were convinced to convict Dr. Raynaldo Ortiz.

Texas police departments have the discretion to determine the frequency and extent of additional driving training for their officers. While some require driving training yearly or every other year, others do not.

Some departments opt to melt the firearms down, while others choose to crush them. However, there are instances where firearms, or at least parts of them, escape destruction altogether.

Several police departments told the CBS News Texas I-Team they were unaware of this practice, even though it was stated in the contracts they signed with the company, Gulf Coast GunBusters.

The Supreme Court convened to consider whether former President Donald Trump is entitled to broad immunity from criminal charges in the 2020 election case.

A Texas grand jury indicted more than 140 migrants on misdemeanor rioting charges over an alleged mass attempt to breach the U.S.-Mexico border, a day after a judge threw out the cases.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

Starting in September of 2024, the year-long residency will allow new teachers to work with veteran teachers before taking on their own classroom.

President Biden signed a foreign aid package into law that includes a potential ban on TikTok in the U.S. Here's what experts say could happen next.

Self-driving 18-wheelers have longtime truckers worried about their livelihood and others concerned that the technology needs more testing to make sure the public is safe.

McDonald's concept restaurant CosMc's has taken its drink-focused menu to Dallas for its second-ever location.

With the country on the cusp of greeting the return of spring, a warm-weather treat is once again available for free for a limited time only.

Kelli and Michael Regan were looking for a new dog. The breeder they found online asked them to pay with gift cards.

Target, looking for ways to add sales, is relaunching its Target Circle loyalty program including a new paid membership with unlimited free same-day delivery in as little as an hour for orders over $35.

The CDC estimates the U.S. could reach 300 measles cases in 2024 — more than the recent peak two years ago.

Organic option is best when buying certain produce, especially blueberries, nonprofit group says in analysis of chemical residues.

The $872 million most likely excludes any amount UnitedHealth may have paid to hackers in ransom.

More than 20 people have been stricken after getting fake or mishandled injections in homes and spas, feds warn.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

Within hours of the vote, the U.S. Chamber of Commerce announced it would sue to block the ban. Dallas employment attorney Rogge Dunn predicts employees will ultimately win this battle.

The closure affects both Dom's locations in Chicago, and all 33 Foxtrot stores in Chicago, Texas, and the Washington D.C. area.

Texas law SB 14 prohibits drug and surgical "gender transition" interventions for minors.

The projects are expected to create at least 17,000 construction jobs and 4,500 manufacturing jobs.

After more than 40 years in business, 99 Cents Only Stores, a discount chain, announced on Thursday that it will close all 371 of its locations and cease operations.

With the departure of Tyron Smith, Guyton has massive shoes to fill at left tackle. The starting job will not be given to him, but Jones did not draft him to watch him sit on the bench.

The 2024 NFL Draft kicks off Thursday night in Detroit.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

Straight out of the 2024 Big Green NFL Draft Scouting Notebook, here's who the Cowboys won't draft this year, but should.

Noah Hanifin broke a tie with an unassisted goal late in the second period and the Stanley Cup champion Vegas Golden Knights beat the top-seeded Dallas Stars 3-1 on Wednesday night to take a 2-0 lead in the first-round series.

Harvey Weinstein's 2020 conviction on felony sex crime charges has been overturned by the State of New York Court of Appeals.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

Taylor Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.

The singer was found deceased at her home, a representative said.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

Storms are more likely this morning and early afternoon.

The Dallas-based airline says it lost $231 million. As a result, they will be cutting back on hirings and ending flights to four airports.

DISD announced that classes on Friday were canceled at Roosevelt High School of Innovation. The announcement came around midnight, hours after two students were shot near campus.

Life in prison or the death penalty will be next for Jerry Don Elders, who is facing sentencing Friday. A jury found him guilty Thursday of capital murder for killing Robin Wadell in 2021 after shooting an officer during a traffic stop.

In Forney, the search is growing for Wade Robison. The 22-year-old is believed to have walked away after crashing his car along Highway 80 and FM 460 Sunday. Thursday morning, Dallas Fire Rescue searched a nearby creek and have announced this is now a recovery mission.

Dallas artist Roberto Marquez traveled to the Rafah Crossing in Egypt, the U.S. capital and will attend this weekend's statewide protest in Austin.

On Friday, hundreds of thousands of fans gathered outside and all around Globe Life Field in Arlington to celebrate the Texas Rangers historical World Series win!

Babies in the neonatal intensive care unit at several Texas Health hospitals were dressed in creative costumes for Halloween.

Is that the smell of cotton candy, beignets and brisket wafting over Fair Park? It sure is, and we are here for it!

No one puts these dolls back in their boxes. Babies in the neonatal intensive care unit at Texas Health Harris Methodist Hospital Southwest Fort Worth are pretty in pink!