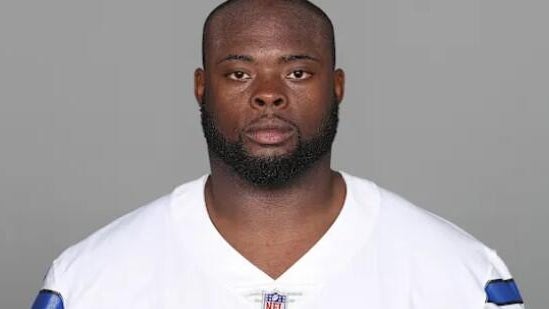

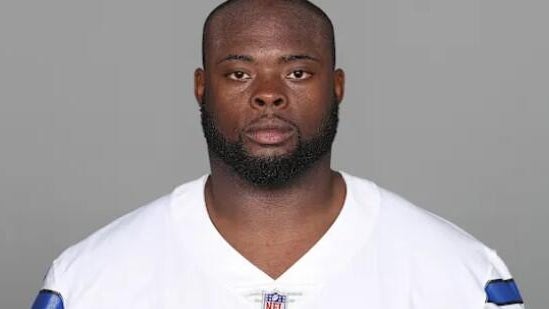

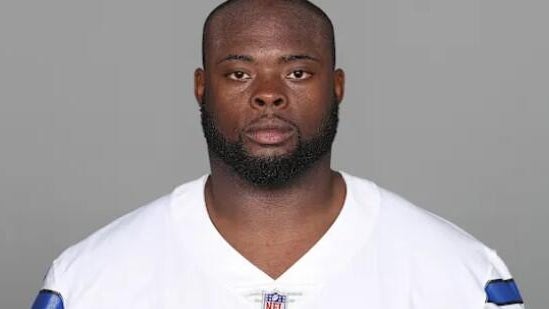

Dallas Cowboys guard Rob Jones out 2-3 months after breaking bone in neck

Dallas Cowboys guard Rob Jones says he broke a bone in his neck during the first padded practice of training camp and is expected to miss two to three months.

Watch CBS News

Dallas Cowboys guard Rob Jones says he broke a bone in his neck during the first padded practice of training camp and is expected to miss two to three months.

Join CBS News Texas and Chef Tim Love for a flood relief benefit show to help Hill Country rebuild.

The preliminary investigation indicates the two teen boys were inside a bedroom when gunshots were heard by an adult resident, police said.

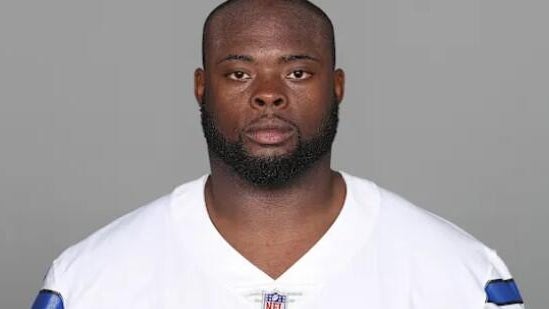

Dallas Cowboys owner and general manager Jerry Jones sat down for a one-on-one conversation with CBS Sports Texas' Bill Jones at Cowboys training camp in Oxnard, Calif. over the weekend.

Head Colorado Buffaloes football Coach Deion "Coach Prime" Sanders revealed his bladder cancer diagnosis for the first time on Monday morning.

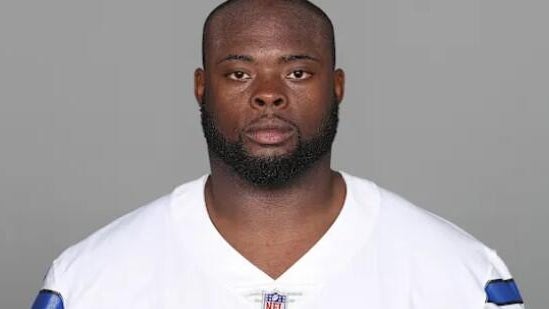

A heat advisory will go into effect starting at 12 p.m. Monday and will continue through 7 p.m. Tuesday.

Tariffs are generally paid for by the importing business in the U.S. to the U.S. government.

A first-of-its-kind program based in Fort Worth is helping first responders do something they rarely get to do: slow down, step away and begin to heal.

The extreme heat is expected on Monday in the Midwest, the Southeast and some parts of the Northeast.

Several organizations are accepting donations for those impacted by the floods, as well as first responders and volunteers.

Join CBS News Texas and Chef Tim Love for a flood relief benefit show to help Hill Country rebuild.

After the floods that impacted Central Texas on July 4, 39 local and national sports organizations came together to launch the Texas Sport Healing Fund.

The Dallas entrepreneur is teaming up with local groups to support victims and first responders after deadly Central Texas flooding.

Top state officials are testifying that communication needs to improve between the state and local officials, between first responders, and with the large number of volunteers on the ground.

The school district notified parents about the subpoena via letter on July 24.

For the first time, we're seeing video that shows a Grand Prairie city councilman allegedly assaulting a real estate broker, which led to his arrest.

While a North Texas man nearly cut in half by a boat during a family trip to the Bahamas remains hospitalized in Miami, his wife is urging Bahamian authorities to arrest and charge those responsible.

CBS Sports Texas Bill Jones and DallasCowboys.com Columnist Mickey Spagnola break down the latest from Cowboys Training Camp in Oxnard, CA. Veteran guard Rob Jones is sidelined with a neck injury just after the first padded practice of training camp, while tight end Jake Ferguson secures a 4-year, $52 million extension with $30M guaranteed.

A heat advisory is in effect starting at 12 p.m. today and continuing through 7 p.m. tomorrow due to a heat index value reaching up to 107 degrees.

A 42-year-old man entered the Traverse City Walmart around 4:43 p.m. on Saturday and used a folding knife to stab five men and six women, according to the Grand Traverse County Sheriff's Office.

CBS Texas and Chef Tim Love are teaming up to host a benefit concert to help those impacted by the Central Texas flood disaster. The event is Sunday, August 3 at Tannahill's Tavern & Music Hall

A first-of-its-kind program based in Fort Worth is helping first responders do something they rarely get to do: slow down, step away and begin to heal.

A heat advisory is in effect starting at 12 p.m. today and continuing through 7 p.m. tomorrow due to a heat index value reaching up to 107 degrees.

A heat advisory will go into effect starting at 12 p.m. Monday and will continue through 7 p.m. Tuesday.

A heat advisory goes into effect Monday afternoon and remains in effect until Tuesday night.

The National Weather Service has issued a heat advisory for Monday at noon to Tuesday, 7 p.m. The heat Index could hit 107°F.

For migrant children, who range in age from 3 to 17 years old and arrive in the U.S. without a guardian, applying for asylum can be a confusing obstacle.

SB 36 will create a division of Homeland Security within Texas's Department of Public Safety.

Two weeks ago, the Trump administration began carrying out its latest tactic aimed at fast-tracking deportations.

The detentions come on the heels of similar arrests earlier this week in immigration courts across the country.

Multiple sources have confirmed that at least a handful of people were arrested on the spot after their cases were dismissed in Dallas.

While illegal migrant crossings have dropped, immigration courts now have a historically high volume of cases

With the expansion of the 287(g) program, local and state officers will be able to enforce some immigration duties.

While the Trump administration says they're only targeting criminals for deportation, those words have done little to comfort some immigrants

A few weeks into his second term, President Donald Trump has issued dozens of executive orders.

Dallas Cowboys guard Rob Jones says he broke a bone in his neck during the first padded practice of training camp and is expected to miss two to three months.

Dallas Cowboys owner and general manager Jerry Jones sat down for a one-on-one conversation with CBS Sports Texas' Bill Jones at Cowboys training camp in Oxnard, Calif. over the weekend.

Head Colorado Buffaloes football Coach Deion "Coach Prime" Sanders revealed his bladder cancer diagnosis for the first time on Monday morning.

Jackie Young scored 24 points, Jewell Loyd had a strong game off the bench and the Las Vegas Aces beat the Dallas Wings, who rested rookie star Paige Bueckers, 106-80.

Bubba Wallace became the first Black driver to win on Indianapolis Motor Speedway's 2.5-mile oval, beating out Kyle Larson on Sunday in the Brickyard 400.

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Eat See Play: Sponsored by Metroplex Cadillac Dealers

Dallas Cowboys guard Rob Jones says he broke a bone in his neck during the first padded practice of training camp and is expected to miss two to three months.

Join CBS News Texas and Chef Tim Love for a flood relief benefit show to help Hill Country rebuild.

The preliminary investigation indicates the two teen boys were inside a bedroom when gunshots were heard by an adult resident, police said.

Dallas Cowboys owner and general manager Jerry Jones sat down for a one-on-one conversation with CBS Sports Texas' Bill Jones at Cowboys training camp in Oxnard, Calif. over the weekend.

Head Colorado Buffaloes football Coach Deion "Coach Prime" Sanders revealed his bladder cancer diagnosis for the first time on Monday morning.

The nonprofit employs men and women who have had past run-ins with the law to work as mentors for at-risk teens and young men.

Sidhartha "Sammy" Mukherjee and his wife Sunita became known for their Bollywood-style performances, became local celebrities, hosting parties and headlining music and cultural events.

On Thursday, the Texas House and Senate announced the creation of committees on disaster preparedness and flooding.

In what experts call "Flash Flood Alley," the terrain reacts quickly to rainfall steep slopes, rocky ground, and narrow riverbeds leave little time for warning.

For days before catastrophic floods left parts of Central Texas inundated, the National Weather Service was tracking the chance of rain.

Tariffs are generally paid for by the importing business in the U.S. to the U.S. government.

The Justice Department seeks to terminate the Flores Settlement Agreement, which requires U.S. immigration officials to hold migrant children in facilities that are safe and sanitary, among other protections.

Operation Grayskull helped shutter four heavily trafficked dark web sites where violent child sexual abuse materials were traded and housed.

President Trump met with top European officials demanding fairer trade with the 27-member European Union at his golf course on the Scottish coast.

Earlier this year, President Trump confirmed that the Qatari royal family was donating a Boeing 747-8 for his use.

At Fort Worth ISD's North Side High School, the sounds of an American sport on the field meet mariachi music in the stands.

With new foods, such as the "Drowning Taquitos" and the "Beso de Angel," Tony's Taco Shop owners say they don't take their success for granted.

Latinas in Tech DFW started back up last year after the pandemic. They have lots of opportunities for Latinas to network, connect, and learn new skills.

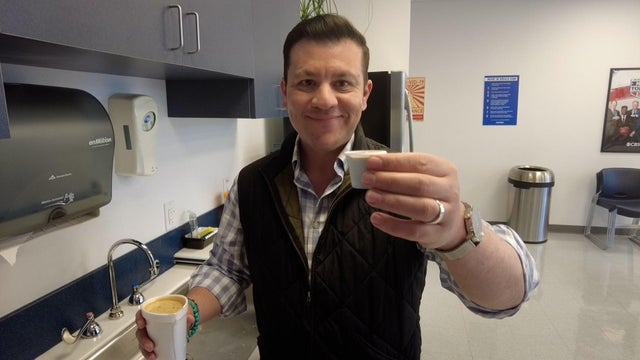

Anchor Ken Molestina shows us how he makes his Cuban coffee for the CBS News Texas newsroom.

Del Olmo, who has played golf his entire life, recalls how rare the sport was for people like him growing up in Mexico City.

Less than two days after Delta Air Lines offered $30,000 to each passenger on board the flight that crashed and flipped in Toronto on Monday afternoon, the company is facing its first two lawsuits in the incident — and they likely won't be the last.

Texas Agricultural Commissioner Sid Miller is calling for a statewide ban on non-water additives, such as fluoride, in the public water system.

Last year, over 16 million vehicles drove on North Texas toll roads without paying, accumulating more than $69 million in unpaid tolls.

Activists are calling for a nationwide boycott of Target stores following the company's decision to roll back its diversity, equity and inclusion initiatives.

Discount store chain Target says it's joining rival Walmart and a number of other prominent American brands in scaling back corporate diversity, equity and inclusion initiatives.

Pepsi hops on another nutritional bandwagon as more consumers opt for prebiotic beverages.

Many Southeast, Southern and West Coast states are likely seeing an increase in COVID cases.

It's therapy that doesn't exactly look like therapy: outdoors, alongside a horse. Across North Texas, the demand for it is soaring.

Scientists conducting medical research are facing an existential crisis: Layoffs and budget cuts pushed by President Trump that, they say, jeopardize finding a cure for cancer.

A Dallas mail carrier died Saturday after collapsing on his mail route on the first day of summer.

A truck had smashed through the front of Bruno's Place, destroying much of the inside.

Kroger said it intentionally decreased prices, but some customers said the financial drop at the register went in a different direction.

Could the solution to school shootings be drone first responders? An Austin-based tech company thinks so and is testing them at a private high school in Aurora.

Located off the Guadalupe River in Historic Old Ingram Loop, the shop was once filled floor to with lighting, decor and trinkets.

They were already concerned about tariffs, but construction businesses in North Texas said they have new fears with the president's immigration crackdown.

Dallas Cowboys guard Rob Jones says he broke a bone in his neck during the first padded practice of training camp and is expected to miss two to three months.

Dallas Cowboys owner and general manager Jerry Jones sat down for a one-on-one conversation with CBS Sports Texas' Bill Jones at Cowboys training camp in Oxnard, Calif. over the weekend.

Head Colorado Buffaloes football Coach Deion "Coach Prime" Sanders revealed his bladder cancer diagnosis for the first time on Monday morning.

Jackie Young scored 24 points, Jewell Loyd had a strong game off the bench and the Las Vegas Aces beat the Dallas Wings, who rested rookie star Paige Bueckers, 106-80.

Bubba Wallace became the first Black driver to win on Indianapolis Motor Speedway's 2.5-mile oval, beating out Kyle Larson on Sunday in the Brickyard 400.

Paramount Global and Skydance Media agreed to merge last year.

Wrestling icon Hulk Hogan has died, police and World Wrestling Entertainment said Thursday.

Ozzy Osbourne rose to fame in the heavy metal group Black Sabbath.

The Alamo has acquired Pee-wee Herman's iconic bike from the 1985 film "Pee-wee's Big Adventure."

Actor and director Malcolm-Jamal Warner, best known for his role on "The Cosby Show," has died.

A suspect was taken into custody after an attack on Pearl Street Mall in Boulder on June 1 in which there were 15 people and a dog who were victims. The suspect threw Molotov cocktails that burned some of the victims, who were part of a march for Israeli hostages.

The Neonatal Intensive Care Unit babies at Texas Health locations across North Texas celebrated Valentine's Day.

As Anthony Davis prepared for his debut game at the AAC, Dallas Mavericks fans took to the arena to protest the controversial trade.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

CBS News Texas viewers got out and enjoyed the snow day on Thursday and send us all of their best photos. Take a look.